The Forex (Foreign Exchange) Market is the world’s largest financial market where people, banks, and institutions buy and sell currencies. The word Forex comes from “Foreign” + “Exchange.”

It’s a global, decentralized market (no single exchange like stock markets).

Daily trading volume is $7.5+ trillion (as of 2024, BIS report).

Traders make profit by speculating on whether one currency will rise or fall against another.

Got questions? Chat with us anytime via WhatsApp to get started.

Table of Contents

ToggleWhat is forex and how does it work?

Take a closer look at everything you’ll need to know about forex,

including what it is, how you trade it and how leverage in forex

works. Interested in forex trading with us

What is forex?

Forex trading, also known as forex trading and FX trading, involves exchanging one currency to another. The forex market is the world’s largest active market, with individual, companies and banks transecting approximately $7.51 trillion a day.

Trading here occurs through pink sheets, over-the-counter transactions, and is monitored by the exchange. Trading is transparent due to the abundant liquidity available.

It has the highest liquidity market in the world.

Although most foreign exchange transactions are conducted for practical purposes, most currency conversions are conducted by currency traders to make a profit. Before starting foreign exchange trading, it is important to note that the daily volume of currency exchanges can cause significant fluctuations in the value of some currencies.

We are one of the world’s leading retail forex providers with major, minor and exotic currency pairs available for you to buy and sell.

Ready to start forex trading? Open an account to get started?

Learn currancy trading from beginner to pro: Follow these steps

The Forex market is the world’s most traded market with the highest volume, where the world’s largest businessmen, companies, and banks trade. Learning to trade in this market can make profits and provide a safe option for building a secure future.

Currency exchange has been a trade between countries for centuries. Merchants converted one country’s currency into another, earning commissions along the way. Because the currencies of different countries have always differed in weight, size, and content, the rates of different countries were fixed based on the proportion of gold and silver in their coins. This led to differences in their base values. Therefore, traders could earn substantial profits by exchanging them.

1.Essential factors of forex trading for beginners

What is forex currency pair & types :

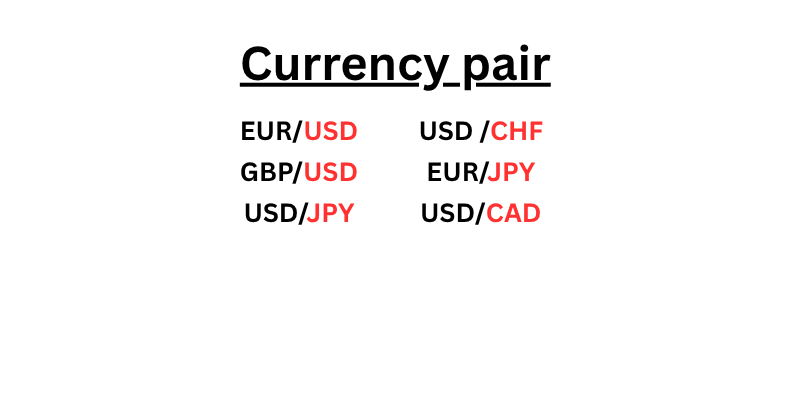

A forex pair is a set of different currencies that are traded against each other. There are many pairs available in the market, but some of the most popular, for example, EUR/USD, USD/JPY, and GBP/JPY, have the highest volume in the market.

There are three types of currency pairs:

1. Major currency pairs: These are the most actively traded pairs and always include the US dollar. They are highly liquid, exhibit low volatility, and have low spreads. Therefore, they are popular with both new and experienced traders.

Major Currency Pairs List (Top 7)

Major Currency Pairs List (Top 7)

| Pair | Name | Currencies | Example Meaning |

|---|---|---|---|

| EUR/USD | Euro / U.S. Dollar | 1 Euro = X USD | Most traded pair in the world |

| GBP/USD | British Pound / U.S. Dollar | 1 Pound = X USD | Called “Cable” |

| USD/JPY | U.S. Dollar / Japanese Yen | 1 USD = X Yen | Very liquid, popular in Asia |

| USD/CHF | U.S. Dollar / Swiss Franc | 1 USD = X CHF | Safe-haven currency pair |

| USD/CAD | U.S. Dollar / Canadian Dollar | 1 USD = X CAD | Correlates with oil prices |

| AUD/USD | Australian Dollar / U.S. Dollar | 1 AUD = X USD | Commodity currency pair |

| NZD/USD | New Zealand Dollar / U.S. Dollar | 1 NZD = X USD | Also commodity-linked |

These qualities are make them very popular:

- High liquidity

- Low spread

- Stability

- Economic significance

2. Minor currency pairs:

Although these pairs don’t involve the dollar, they do include two major global currencies: EUR/GBP and GBP/JPY. These are also known as cross-currency pairs. Trading these also offers profitable opportunities, but they offer greater variability. The EUR, GBP, and CHF are combined with GBP, USD, and USD to form 12 major minor currency pairs.

3. Exotic currency pairs:

In these pairs, one is the major currency like EUR, USD, GBP and the other currency is of the countries with small economies like INR,MXN, ZAR,etc.

These pairs have lower liquidity, wider spread and higher volatility, hence the risk of loss when trading them is higher.

What are the base and quote currencies?

The base currency is always on the left side of the pair, and the quote currency is always on the right side. The value of the base currency is always equal to 1 UNIT, and the value of the quote currency is equal to the current quota value of the pair, which indicates how much quota currency would be required to buy one of the base currencies. Therefore, when we trade currencies, we always sell one currency and buy another.

- Currencies in the forex market are always traded in pairs.

- The price of a pair is how much it costs for the quote currency to buy one unit of the base currency.

- When you trade forex, you always buy one currency and sell the other.Example: EUR/USD = 1.17289

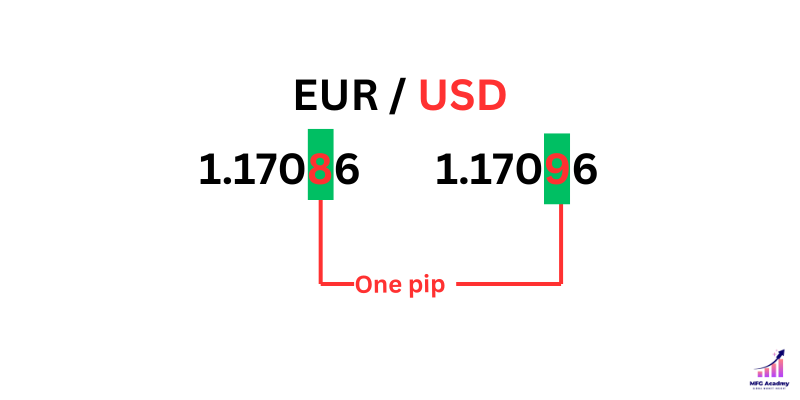

What is pip in forex?

In Forex, a pip means a movement of one digit in the 4th decimal place in a currency pair.

Example: EUR/USD = 1.17086 increases to 1.17096, which is a move of 1 pip.

But if you trade a JPY cross currency pair, a pip is a change in the 2nd decimal place.

Changes in the 5th decimal place are called pipettes.

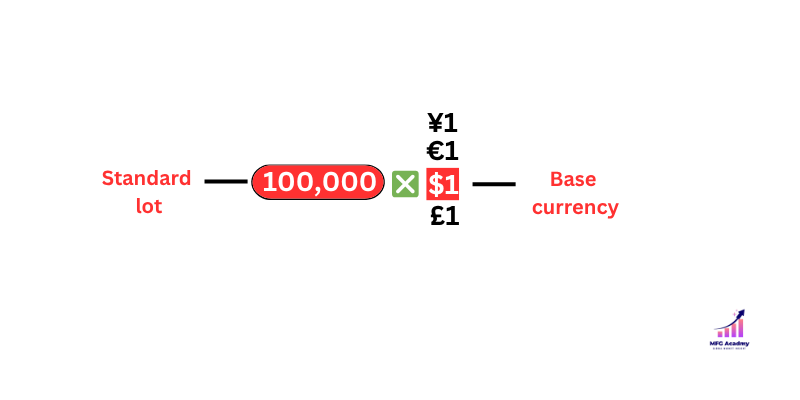

what is lot size in forex trading?

Currencies are traded in lots, which are used to standardize currency pair trading in forex trading.

Since the fluctuations in forex pairs are very low, so the lot size is very large.

Example: According to the picture

2.How does forex trading works

Forex trading works just like any other transaction where you buy an asset using any currency. In forex too, the market price tells a trader how much of one currency is needed to buy another currency.

For example, the current market price of EUR/USD in this pair shows how many US Dollars it takes to buy one Euro.

Each currency has its own three-letter specific code that allows traders to identify it as part of the currency.

Each currency has a unique code which have 3 letters. Which is certified by ISO.

How to trade in the forex market

Buying a currency pair means you expect its price to increase, which means the base currency is gaining strength against the quote currency.

Selling a currency pair means you expect its price to fall, meaning the base currency is weakening against the quote currency.

Example: If you believe the euro will strengthen against the dollar, you buy the euro/usd pair. This means you will need more dollars to buy 1 euro.

If you believe the euro will weaken against the dollar, you sell the euro/usd pair. This means you will need fewer dollars to buy 1 euro.

What is spread in forex trading?

Difference between buy or sell price of currency pair is called spread.

What is margin and laverage in forex trading?

Margin is the initial deposit you need to make to open and maintain a leveraged position.

Example:- Opening a trade on EUR/USD requires a 0.50% margin. As a result, you will need only $500 to open a position, not $100,000.

Leverage To open a trade with leverage, you need to deposit more than the amount you can invest in the market. Leveraged products like CFDs magnify your potential profits and losses. are you ready to start trading with leverage?

Leverage is a type of loan provided by a broker.

3.Why do people trade foregin currencies

Taking a position on currencies according their strengthening or weakening

The trader predicts the strength or weakness of the currencies in the pair. When the price of a quote currency is rising, it means that the base currency is gaining strength against the quote currency, and when the price is falling, it means that the base currency is losing strength against the quote currency.

Based on these, traders will take long positions in case of buying and short positions in case of selling.

- Scalping:-Positions are opened and closed quickly with the aim of taking small profit.

- Day trading:- Position are opened and closed within a day.

- Swing trader:- traders look for max. high or max low, then place trades in anticipation of a price reversal.

- Trend trading:- Position are opened in line with an overall trend.

- Position trading:- Positions are hold for along time -weeks,months even years.

Hedgind with another pair of currency

One way to reduce your risk is by opening positions that will generate profits if some of your other positions decline in value, or this profits can offset losses in earlier positions.

example:- EUR/USD and GBP/USD are both positively correlated as they move in the same direction. If you have a long position in EUR/USD, you can take a short position in GBP/USD to protect against a potential downside.

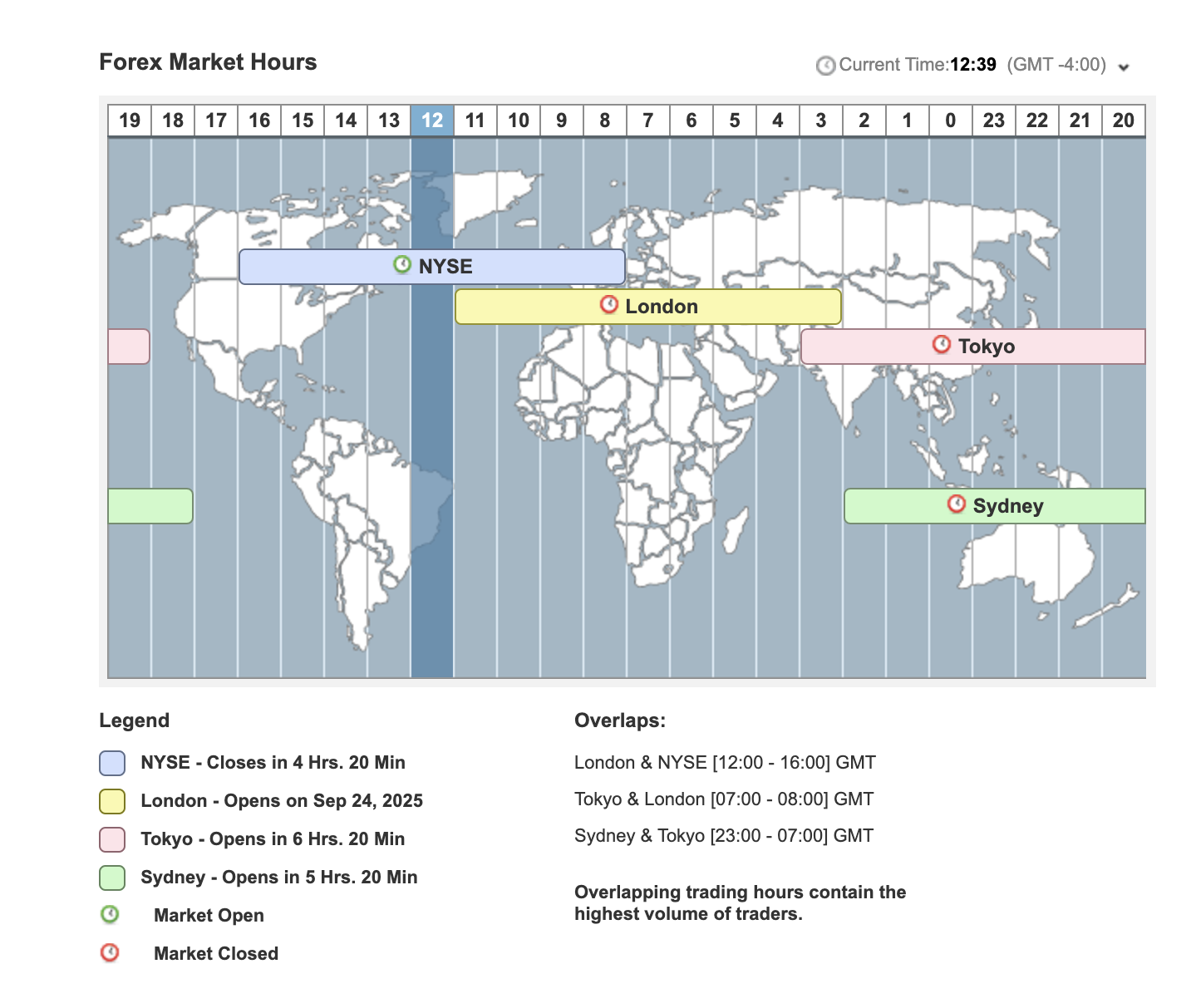

24 hrs marketing opportunity in a day

The forex market is open 24 hours a day thanks to a global network of banks and market makers around the world who constantly exchange currencies. The main sessions take place in the United States, Europe, and Asia, and there is virtually no difference in session times between these locations, enabling the forex market to remain open for almost 24 hours.

Forex market hours are incredibly attractive, giving you the ability to take advantage of opportunities 24 hours a day.

Learn more about people trade forex

4.How currency market work, let's know?

The forex market is made up of currencies from around the world, so predicting exchange rates can be difficult because many factors contribute to influencing currency values. All of the above factors affect the forex market.

Central banks

The supply of a currency is controlled by central banks, which can announce measures that will have a significant impact on the price of that currency. For example, quantitative easing involves injecting more money into the economy, and this will increase the supply and cause the price of the currency to fall.

News reports

Commercial banks and other investors often seek to invest their capital in economies that have a strong future. Therefore, positive news will boost investment and increase demand for that region’s currency. If the news is negative, demand can be expected to decline. This is why currencies reflect the perceived economic health of the region they represent.

Market sentiments

A market phenomenon that often reacts to news. If traders believe a currency is moving in a particular direction, they will trade accordingly and may encourage others to do the same, increasing or decreasing demand for the currency.

5.How to become a forex trader?

There are several ways to trade forex including trading spot forex, forex futures and currency options.. You can speculate on the price fluctuations of forex currencies, energy metals, and other currencies through a forex commodity futures and forex currency options account. Support forex trading allows you to trade at their current market price without any fixed expiry date.

What is forex Broker?

A forex broker provides access to a platform from which to buy and sell foreign currency. When you trade forex with us, you will be able to use our award-winning platform and MT5. Both are amazing. A broker usually charges fees in the form of a spread.

Traditionally, a forex broker buys and sells currencies on behalf of its clients or retail traders. However, with online trading, you can buy and sell currencies yourself through financial derivatives like CFDs. The only condition is that you must have access to a trading platform. Trades are conducted over the counter(OTC), not on an exchange like stocks.

Benifits of forex trading

Forex trading is the world’s most widely traded financial market. Foreign currency prices fluctuate constantly, providing greater trading opportunities. Currancy Pair containing the dollar are often more stable and liquid because it is the world’s reserve currency, and therefore, there is greater demand for it in the market.

6.Here's a to-do list to get you started.

- Learn about forex: You now have the basic concepts, but you’ll need to understand more of the terminology and how the forex market operates. This includes learning currency pairs, market patterns, and the factors influencing currency prices.

- Develop a trading strategy: Learn the different trading strategies, such as various technical analysis strategies, fundamental analysis, and news trading. Choose a strategy that aligns with your trading style and risk tolerance. For more, see Forex Trading Strategy and Education.

- Develop a plan: Create a trading plan that includes your goals, risk tolerance, strategies, and the criteria you’ll use to assess trades. The most crucial part is not just making a plan but sticking to it in the heat of trading when emotions run high. Successful traders are disciplined traders.

- Set up a brokerage account: Select a broker regulated by a reputable financial authority, such as the Commodities Futures Trading Commission (CFTC) in the U.S., and ensure the broker offers a user-friendly trading platform, good customer support, and low fees. For ideas, see Best Forex Brokers.

- Practice with a demo account: Many forex platforms provide the ability to paper trade before you put skin in the game. This is a time to ensure you’ve locked down all the mechanics of trading and tested your strategies. It’s better to identify your mistakes and weaknesses in practice mode than when your money is on the line.

- Start slowly: Once you feel confident with your practice trading, start trading with real money. Start off small to manage risk and gradually increase your trading size as you gain experience.

- Stay on top of your holdings: Regularly check your positions and ensure you have enough funds in your account. Use stop-loss and take-profit orders to manage risk and protect your profits.

- Monitor and adapt: Keep up with market news, economic indicators, and geopolitical events likely to affect currency prices. Be prepared to adjust your strategies as market conditions change, which is not the same as adapting your strategy with every price move.

7.Forex trading course and webinars

To succeed when trading forex, you’ll need to take advantage of educational resources and platforms to help you build your confidence. We offer both: MFG Acadmy and our demo account.

MFG Academy has a wealth of information to get you acquainted with the markets and learn the skills needed for boosting your chances of trading forex successfully. Alternatively, you can use an demo account to build your trading confidence in a risk-free environment, complete with $10,000 in virtual funds to plan, place and monitor your trades.

We also offer trading strategy and news articles for all experience levels. This includes ‘novice’, like how to be a successful day trader, up to ‘expert’ – looking at technical indicators that you’ve perhaps never heard of.

8.Frequently asked questions

Much like other types of trading or investing, there are risks associated with forex trading as well. However, there are certain things which are exclusively present in forex trading. For instance, leverage is being provided which can generate huge profits or incur large losses. The customer should understand this thoroughly, so that they are more prepared as a forex trader. MOreover, there are numerous other variables that contribute to potential profitability or increase potential risk. The best way to achieve your investment/financial goals and avoid unnecessary risk is to have a strategy, a well-defined risk limit and be aware of all the events happening that can cause market volatility.

There are many currency pairs that are being traded. However, few pairs are being traded the most. They are being traded in high volumes and represent some of the world’s biggest economies. To name a few:

EUR/USD – Euro Dollar

USD/JPY – Dollar Yen

GBP/USD – Pound Dollar

USD/CHF – Dollar Swiss Franc

Now that you have a fair idea about forex, this is the time you should know how to calculate your profit or loss. On every trade close, subtract the exchange rate for selling the base currency with the exchange rate for buying the base currency, the difference will be multiplied with the transaction size. The result would tell you your profit or loss.

Unlike other trading platforms, forex trading works 24 hours a day for 5 days. Traders can trade at their convenience. As for the best time to trade in Forex, this depends on the trader to trader, their aim/target, preferences, and so on.

Trading in forex is a good opportunity. However, this needs some skills to be developed.

In any case, on an individual level, it is a long-lasting excursion of dominating forex trading and creating and culminating the aptitudes and strategies that expand your odds to turn into a beneficial forex trader.

Forex trading can be very difficult and frustrating if the goal is to make money/profits quickly. Moreover, you would end up in losses. To get success in forex trading, you should have a complete plan. And this includes how the market works and what is the trading process to earn money, what is the trading behaviour, price, market volatility and so on.Accordion Content

Your residing country forex regulatory will decide if global forex brokers would acknowledge customers from your nation. Check with a broker straightforwardly to see if they will acknowledge you as a customer and ensure they offer all the types of assistance and devices you require.

Whenever you have limited your determination down to a couple of reasonable brokers, investigate their online audits and check whether they have a moderately fulfilled client base. In the event that you don’t perceive the broker, at that point perceive how they contrast with a notable and controlled online broker

There is no fixed amount that you can start with however if someone is starting with a decent amount gives you flexibility in how you can trade. Moreover, a higher amount can help you produce a reasonable amount of income that will compensate you for the time you’re spending on trading.

A lot of people do part-time forex trading and they work very hard. However, they take a hit in their home life. Sometimes to become a quality trader becomes very stressful but extremely rewarding. So to become a full-time trader: Pass the learning curve, plan your strategy, and have patience.

Major Currency Pairs List (Top 7)

Major Currency Pairs List (Top 7)